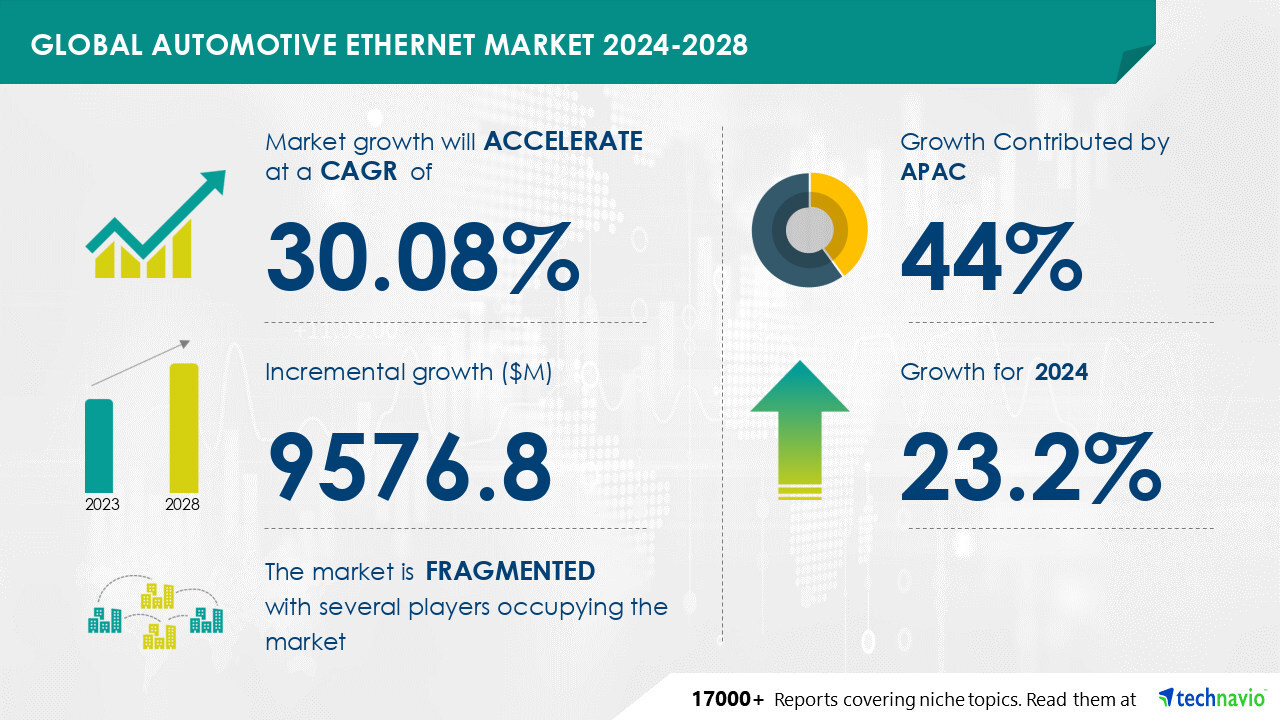

NEW YORK, Aug. 6, 2024 -- The global automotive ethernet market size is estimated to grow by USD 9.57 billion from 2024-2028, according to Technavio. The market is estimated to grow at a CAGR of 30.08% during the forecast period. Increasing demand for high bandwidth and lightweight materials is driving market growth, with a trend towards use of ethernet to lay the backbone network of vehicles. However, oems skeptical about adopting ethernet in vehicles poses a challenge. Key market players include ACTIA PCS, Amphenol Communications Solutions, Broadcom Inc., Cadence Design Systems Inc., Dasan Network Solutions, Infineon Technologies AG, Intrepid Control Systems Inc., Keysight Technologies Inc., Marvell Technology Inc., Microchip Technology Inc., Mouser Electronics Inc., NEXCOM International Co. Ltd., NXP Semiconductors NV, Realtek Semiconductor Corp., Rohde and Schwarz GmbH and Co. KG, Spirent Communications plc, System on Chip Engineering S.L., TE Connectivity Ltd., Tektronix Inc., and Texas Instruments Inc..

Get a detailed analysis on regions, market segments, customer landscape, and companies - Click for the snapshot of this report

Forecast period | 2024-2028 |

Base Year | 2023 |

Historic Data | 2018 - 2022 |

Segment Covered | Vehicle Type (Passenger cars and Commercial vehicles), Application (Cameras and ADAS, Infotainment, Diagnostics, and Network backbone), and Geography (APAC, North America, Europe, South America, and Middle East and Africa) |

Region Covered | APAC, North America, Europe, South America, and Middle East and Africa |

Key companies profiled | ACTIA PCS, Amphenol Communications Solutions, Broadcom Inc., Cadence Design Systems Inc., Dasan Network Solutions, Infineon Technologies AG, Intrepid Control Systems Inc., Keysight Technologies Inc., Marvell Technology Inc., Microchip Technology Inc., Mouser Electronics Inc., NEXCOM International Co. Ltd., NXP Semiconductors NV, Realtek Semiconductor Corp., Rohde and Schwarz GmbH and Co. KG, Spirent Communications plc, System on Chip Engineering S.L., TE Connectivity Ltd., Tektronix Inc., and Texas Instruments Inc. |

Key Market Trends Fueling Growth

Ethernet's address-based messaging feature makes it an attractive option for automotive backbone networks. Unlike CAN networks that use gateways for messaging, Ethernet switches can execute the same process without requiring software upgrades when network topologies change. Additionally, Ethernet networks can accommodate an unlimited number of devices, and multiple switches can be interconnected to expand network capacity. While the current 1TPCE standard may not be suitable for vehicle backbone networks, the enhanced RTPGE version can be used for future car designs. This capability to adapt and expand without software upgrades, combined with the increasing use of ethernet in automotive applications, is expected to fuel the growth of the Automotive Ethernet market during the forecast period.

The Automotive Ethernet market is experiencing significant growth due to the increasing adoption of Ethernet networks in vehicles. Phy transceivers are key components of this technology, enabling high-speed data transfer for infotainment, autonomous vehicles, powertrain, chassis, body and comfort, and high bandwidth applications. Vehicle electromagnetic compatibility and immunity standards are crucial considerations to ensure reliable connectivity. Cost of cable and cabling weight are important factors in the automotive industry, making Ethernet an attractive alternative to traditional harnesses. Navigation systems, telematics, in-vehicle data communications, and IoT solutions are driving the demand for connectivity in vehicles. Automotive manufacturing plants are integrating Ethernet networks into passenger vehicles for safer and more efficient production processes. Autonomous driving requires HD maps, lane sizes, crosswalks, and road signs to be transmitted in real-time, making Ethernet an essential technology. Broadcom Incorporated, NXP Semiconductors NV, Microchip Technology Inc, and Texas Instruments Inc are major players in the Automotive Ethernet market. Safety and security are top priorities, with Euro NCAP and US NHTSA setting standards for connected vehicles. Software-defined vehicles (SDV) and Ethernet ports up to 10 Gbps are future trends. MEMS sensors, vehicle-to-everything (V2X) communications, and electronic control units are also driving the growth of the Automotive Ethernet market. HMI features, GDP growth, and the Indian market are also potential opportunities.

Discover 360° analysis of this market. For complete information, schedule your consultation- Book Here!

Market Challenges

- The automotive industry has seen a significant increase in the use of electronics in vehicles, with modern luxury cars containing over 100 microprocessors and executing over 100 million lines of instructions. Electronics now account for 45% of the cost of a premium vehicle, and this figure is projected to reach 50% by 2030. However, the high initial cost of adopting new technologies, such as Automotive Ethernet, is a major concern for Original Equipment Manufacturers (OEMs). OEMs are hesitant to adopt new technologies due to shrinking margins, uncertainty, and the higher cost of ethernet compared to popular technologies like CAN and LIN. Few OEMs, such as Mercedes-Benz, are still using MOST instead of BroadR-Reach ethernet due to the uncertainty associated with a new technology used for critical vehicle functions. These factors may restrict the growth of the Automotive Ethernet market during the forecast period.

- The Automotive Ethernet market is experiencing significant growth due to the increasing demand for in-vehicle connectivity. Traditional wiring harnesses in automotive parts are being replaced by Ethernet technology for better communication between components. Leading automotive companies are investing in this technology for electric vehicles (EVs) and conventional vehicles alike. The federal government's initiatives for CO2 emissions reduction and the technological development of chipsets and modules are driving this trend. However, challenges such as cybersecurity assaults and the need for charging infrastructure and lithium-ion batteries add complexity. The market can be segmented into vehicle type, vehicle-to-vehicle (V2V) and vehicle-to-infrastructure (V2I) communication, driver assistance, power train, body & comfort, and hardware sub-segment. Key players include NXP Electronics, and the market is estimated to grow despite the impact of lockdowns on auto manufacturers. Buyers and suppliers are looking forward to the benefits of Ethernet technology in infotainment systems, CAN LIN, and autonomous driving functionalities.

For more insights on driver and challenges - Download a Sample Report

Segment Overview

This automotive ethernet market report extensively covers market segmentation by

- Vehicle Type

- 1.1 Passenger cars

- 1.2 Commercial vehicles

- Application

- 2.1 Cameras and ADAS

- 2.2 Infotainment

- 2.3 Diagnostics

- 2.4 Network backbone

- Geography

- 3.1 APAC

- 3.2 North America

- 3.3 Europe

- 3.4 South America

- 3.5 Middle East and Africa

1.1 Passenger cars- The passenger car segment leads the global automotive ethernet market due to the rising demand for advanced safety features. With the electrification of mechanical components and the introduction of innovative safety, security, connectivity, and environmental technologies, the number of electronic control units (ECUs) in passenger vehicles has significantly increased. As a result, there is a growing need for reliable and high-speed data communication among these ECUs. Automakers are focusing on enhancing vehicle safety and are adopting advanced safety functions that require secure communications. This trend is driving the demand for automotive ethernet, which is expected to continue during the forecast period.

For more information on market segmentation with geographical analysis including forecast (2024-2028) and historic data (2018 - 2022) - Download a Sample Report

Learn and explore more about Technavio's in-depth research reports

The global Automotive Advanced Driver Assistance System (ADAS) market is experiencing robust growth due to rising demand for safety features in vehicles. Key drivers include technological advancements and stringent government regulations. Concurrently, the global Automotive Wiring Harness Market is also expanding, driven by the increasing adoption of electric vehicles and advancements in automotive electronics. Both markets are witnessing significant investments from major players aiming to enhance vehicle safety, efficiency, and connectivity, making them pivotal in the evolution of the automotive industry.

Research Analysis

The Automotive Ethernet market refers to the use of Ethernet networks in vehicles for in-car communications. Ethernet Phy transceivers enable high-speed data transfer and real-time responses, making them ideal for automotive applications. However, vehicle electromagnetic compatibility and immunity standards pose challenges. The cost of Ethernet cables is higher than conventional wiring harnesses, but the benefits of in-vehicle connectivity, including improved infotainment systems and autonomous vehicle capabilities, outweigh the costs. Automotive parts manufacturers are integrating Ethernet networks into their systems, replacing traditional communication buses like CAN and LIN. Physical network connections are essential for the proper functioning of electronic components and systems within vehicles. The leading automotive companies are investing in Automotive Ethernet to enhance vehicle performance and safety.

Market Research Overview

The Automotive Ethernet market refers to the use of Ethernet networks in vehicles for in-car communications. Ethernet Phy transceivers enable high-speed data transfer, essential for applications like infotainment, autonomous vehicles, and connected services. Vehicle electromagnetic compatibility and immunity standards are crucial considerations to ensure proper functioning. The cost of cable and cabling weight are significant factors, as is the need for high bandwidth applications in vehicle components. In-vehicle data communications include navigation systems, telematics, and in-vehicle HMI features. Automotive manufacturing plants are integrating Ethernet networks into various vehicle systems, from powertrain and chassis to body and comfort. High bandwidth applications, such as HD maps for autonomous driving, require advanced technologies like MEMS and IoT solutions. Safety and security are paramount, with regulatory bodies like Euro NCAP and US NHTSA setting standards. Passenger vehicles, commercial vehicles, electric vehicles (EVs), and even software-defined vehicles (SDVs) are adopting Ethernet technology. The market's growth is influenced by factors like GDP growth, technological development, and federal government initiatives. Key components include Ethernet ports, chipsets and modules, and lithium-ion batteries for EVs. Cybersecurity and carbon emissions reduction are also important considerations.

Table of Contents:

1 Executive Summary

2 Market Landscape

3 Market Sizing

4 Historic Market Size

5 Five Forces Analysis

6 Market Segmentation

- Vehicle Type

- Passenger Cars

- Commercial Vehicles

- Application

- Cameras And ADAS

- Infotainment

- Diagnostics

- Network Backbone

- Geography

- APAC

- North America

- Europe

- South America

- Middle East And Africa

7 Customer Landscape

8 Geographic Landscape

9 Drivers, Challenges, and Trends

10 Company Landscape

11 Company Analysis

12 Appendix

About Technavio

Technavio is a leading global technology research and advisory company. Their research and analysis focuses on emerging market trends and provides actionable insights to help businesses identify market opportunities and develop effective strategies to optimize their market positions.

With over 500 specialized analysts, Technavio's report library consists of more than 17,000 reports and counting, covering 800 technologies, spanning across 50 countries. Their client base consists of enterprises of all sizes, including more than 100 Fortune 500 companies. This growing client base relies on Technavio's comprehensive coverage, extensive research, and actionable market insights to identify opportunities in existing and potential markets and assess their competitive positions within changing market scenarios.

Contacts

Technavio Research

Jesse Maida

Media & Marketing Executive

US: +1 844 364 1100

UK: +44 203 893 3200

Email: media@technavio.com

Website: www.technavio.com/

This News is brought to you by Qube Mark, your trusted source for the latest updates and insights in marketing technology. Stay tuned for more groundbreaking innovations in the world of technology.